Contents:

These pairs will contain a currency from a non-major economic region – such as South Africa, Peru, Kenya, and Turkey. Naturally, the spreads and volatility levels on exotic pairs can be huge – so stick with majors. Crucially, these pairs are the most traded in the forex scene, and thus – they possess the most liquidity, tightest spreads, and lowest levels of volatility. You can open a FREE demo trading account in just a few minutes and access a range of additional trading indicators and software complimentary.

These indicators are supplemented with Market Analyzer, a feature unique to NinjaTrader that identifies opportunities in real-time. The Japanese Yen has long been popular as the funding currency, because Japanese rates have been low for so long, and the currency is perceived as stable. The strategy works well at a time of buoyant risk appetite because people tend to seek out higher-yielding assets. The action of traders implementing the strategy can itself support the strategy, because the more people using the strategy, the greater the selling pressure on the funding currency. In the chart above, the 25-period moving average is the dotted red line.

Copy a Successful Forex Day Trader

This can be done manually or via an algorithm which uses predefined guidelines as to when/where to enter and exit positions. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Position trading is where traders look to hold trades over much longer periods of time and take a ‘position’ in the market. This style of trading is normally carried out on the daily, weekly, and monthly charts. As position traders, traders will often be trying to use the overall larger trend to gain the best positions and capture long-running trades.

- We have undertaken extensive research to provide all the information you need to make informed decisions about buying the best forex robot.

- The aim of the indicator is to measure the speed and change of price movements to find which direction has more strength.

- Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets.

- The idea behind currency hedging is to buy a currency and sell another in the confidence that the losses on one trade will be offset by the profits made on another trade.

- This approach is suitable even for beginners, especially when trading Forex in the long term.

- The first strategy to keep in mind is that following a single system all the time is not enough for a successful trade.

This uniquely American broker benefits from over 40 years of experience. Built using HTML5 , the platform has at least 28 technical indicators and 19 compatible drawing tools for in-depth analytics. Easily customizable, IG offers users the option to create and save preferred layouts, as well as create custom watchlists. The platform boasts an extensive range of technical and drawing tools to help with market analysis, as well as sophisticated EAs. MetaTrader 4 allows you to integrate a range of third-party software solutions to do even more with the platform. We hope that you have found this introductory guide to easy Forex trading strategies for beginners useful.

Average True Range

The best forex strategy should also allow you to identify the absolute best setups on a daily basis. More specifically, you have to understand where prices are, relative to major Price Levels. If you take trades at irrelevant prices, then don’t be surprised if you keep losing. It’s extremely important for you to take trades only at major Price Levels. Forex, binary options and cryptocurrencies are highly speculative assets.

The result of the trade will be a positive profit between two trades where the length of the positions opened may take hours or even days or weeks. As entry or exit parameter trader may use confirmation from indicators or analysis that confirms the trend, as traders’ profit is eventually an interest rate between two orders. An automated forex strategy generates profits by reducing drawdowns through the accurate placement of stop-loss and take-profit levels with a consistent set of extensively backtested rules. One of the most straightforward forex trading strategies involves identifying and following a price trend move. In fact, the strategies such as Blue Trend operated by hedge fund BlueCrest Capital made billions of dollars of profits for investors during the great financial crisis of 2008.

Forex Scalping ????

Before you embark on your forex day trading career – be sure to consider the 5 day trader tips below. In doing so, you’ll give yourself the best chance possible of avoiding the same costly mistakes made by many newbie day traders. As we have discussed throughout this guide – if you want to day trade forex online – you need to have an account with a safe and low-cost broker.

- Before starting to use this strategy, traders must familiarize themselves with the concept of momentum.

- The theory is that these losses will be offset by more infrequent but larger winning trades.

- While there are now thousands of technical indicators available only a few a worthwhile focusing on – as highlighted in the top 10 best forex indicators section above.

Usually, what happens is that the third bar will go even lower than the second bar. An area on the chart where selling interest overpowers buying pressure. The area on the chart where the buying interest is pointedly strong and exceeds the selling pressure. As a regulated broker, eToro will need you to fill out a questionnaire so they know more about you and to follow regulatory requirements. The Williams %R indicator can be used as an overbought and oversold indicator as well as a divergence indicator as well.

Furthermore, you can tap into the easy-to-access eToro charts for forex from its proprietary feature-rich trading platform. In our example we are using Meta Trader 4 which is the #1 trading platform for Forex traders. We also will be using the EURUSD as an example which is one of the most popular Forex pairs to day trade. Yes – the foreign exchange market is arguably the best asset class to target as a day trader. Not only can you trade 24/7 at industry-leading fees, but forex attracts trillions of dollars worth of volume each and every day. Plus, when trading major forex pairs, you will benefit from super-low volatility levels.

Question: What is the best strategy for trading commodities?

Investopedia requires writers to use primary sources to best strategy for trading forex their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Both review sites and forums provide access to the best forex robot reviews. They provide trusted opinions from forex traders using the automated software or professional reviewers that extensively research a robot to make an informed decision about the best Forex EA. What is the most effective metric to gauge the performance of a forex robot over time?

What is the best forex trading strategy for beginners?

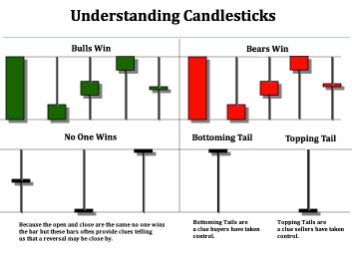

Practice trading Forex with each strategy until you know which one works for you and is the easiest to implement. The upside with this kind of trend is that when you are right, you are spectacularly right. Some trends can carry you for many months, and all you have to do is monitor the trade occasionally. The price consolidated for a couple of days (each candle is 1-hour) and dropped below the consolidation box. For instance, a one-hour candle opens and moves above the previous candle for 45-minutes. But, during the last 15-minutes, the candle retracts and closes below the previous candle.

Top 10 Best Cryptocurrency Trading Courses 2023 Reviews – Biz Report

Top 10 Best Cryptocurrency Trading Courses 2023 Reviews.

Posted: Sat, 04 Mar 2023 16:20:31 GMT [source]

When you have selected a Forex trading strategy, you must develop a foolproof trading plan. Choosing a trading strategy is just the beginning of developing a trading plan. While creating your trading plan, you should also consider factors such as your style of trading and your personality. The best traders use these resources to improve their knowledge and better their strategies. As far as Forex trading is concerned, you can never stop educating yourself.

Because this https://g-markets.net/ trading Forex strategy can be both a sell and a buy strategy, I want to share an example of a sell setup. You can now set up your forex order for the currency pair that you wish to speculate on. EToro – like all regulated brokers in the forex arena, will first require you to open an account. You can do this by visiting the eToro homepage and clicking on the ‘Join Now’ button. Follow the on-screen instructions by entering your personal information and contact details. If the price breaks above the red and the blue line, you would watch and wait to see if it starts to move into the cloud as part of the strategy.

ventas@legoan.com

ventas@legoan.com (+51) 983 415 033

(+51) 983 415 033